Calculate tax per paycheck

Figure out your filing status. Lets say that your regular gross paycheck is 2000 and your bonus is 5000 for a combined total of 7000.

Paycheck Calculator Take Home Pay Calculator

Texas tax year starts from July 01 the year before to June 30 the current year.

. To receive a bigger refund adjust line 4c on Form W-4 called Extra withholding to increase the federal tax withholding for each paycheck. Here your employer adds the amount of your bonus to the amount of your most recent regular paycheck. This is a credit of up to 500 per qualifying person.

For the tax year 2020 check the line 8b on form 1040-SR. Calculate your California net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free California paycheck. Simply select your state and the calculator will fill in your state rate for you.

Calculating your Texas state income tax is similar to the steps we listed on our Federal paycheck calculator. If your monthly pay is flat based on an annual salary then you would simply divide the salary by 12 to come up with the equivalent. Account for dependent tax credits.

For the tax year 2020 check the line 8b on the form 1040. Calculating a level of tax withholding thats just right can sometimes take as much time as preparing your tax return. When done create the W-4 and the.

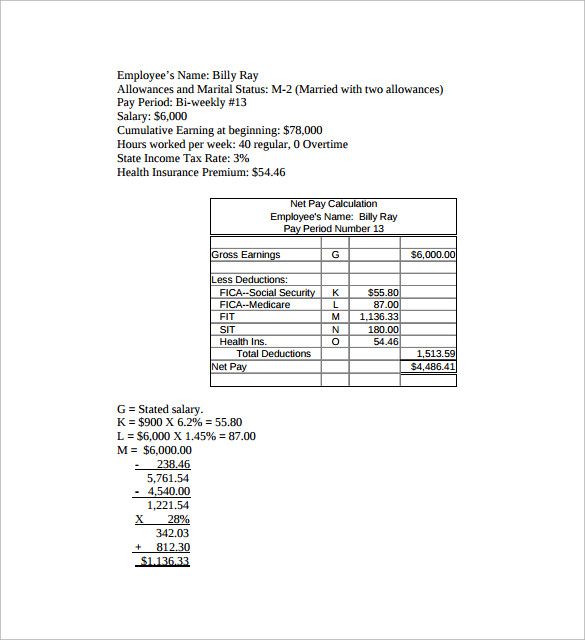

Parents and caregivers should do a Paycheck Checkup to determine how these changes could affect their tax situation. This number is the gross pay per pay period. Subtract any deductions and payroll taxes from the gross pay to get net pay.

Provident Fund It is a deduction that every employer needs to. Lets say you have a job that pays 20 per hour but after taxes and retirement contributions your take-home pay is only 14 per hour. The tax on both gasoline and diesel is 2050 cents per gallon 13th- and 12th-lowest in the country respectively.

Use the PAYucator or W-4 Check tool below and at the end of the paycheck calculator in section P163 you will see your per paycheck tax withholding amount. Gross Salary is calculated as. Calculating your Oregon state income tax is similar to the steps we listed on our Federal paycheck calculator.

The rate has increased slightly since then and now sits at 120 for a pack of 20 cigarettes. Once you have the adjusted annual wages you can use the tax table found on page 6 of IRS Pub 15-T and calculate the annual federal income tax amount. Compute the tax using the aggregate method option 2.

To fatten your paycheck and receive a smaller refund submit a new Form W-4 to your employer that more accurately reflects your tax situation and decreases your federal income tax withholding. Note that the default rates are based on the 2022 federal withholding tables IRS Publication 15-T 2022 Percentage Method Tables pg 10 but you can select prior years. For example if you are paid 20 an hour there are 21 work days in the month and you work 8 hours per day that would be 188 work hours.

Calculate the Gross Salary and Net Salary of the following salary components. This box is optional but if you had W-2 earnings you can put them in here. Pre-Tax Deductions Pre-tax Deduction Rate Annual Max.

Get tax withholding right. W-2 income. IR-2019- 107 IRS continues campaign to encourage taxpayers to do a Paycheck Checkup.

West Virginia Cigarette Tax. This form has various versions. Do a Paycheck Checkup at least once every year.

West Virginia nearly doubled its cigarette tax in 2016. Meaning your pay before taxes and other payroll deductions are taken out. Work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income.

In the United States form 1040 is used for federal income tax returns. But the IRS introduced a new Form W-4 beginning with the tax year 2020 that can simplify the process a bit. The Withholding Form.

Plus the paycheck tax calculator includes a built-in state income tax withholding table. Our Miles Per Hour Calculator can tell you how many miles you drive in a single stretch. Lets also assume that the normal withholding from your regular pay is 500.

Texas state income tax. That is still below average though. Finally you can make any needed tax adjustments for dependents and determine the amount of tax per check.

Plus you will find instructions on how to increase or decrease that tax withholding amount. Gross Salary 480000 48000 96000 12000 12000 12000. Figure the tentative tax to withhold.

Miles Per Hour Definition. Total Non-Tax Deductions. Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs.

The TCJA eliminated the personal. So the tax year 2021 will start from July 01 2020 to June 30 2021. It aligns with changes made by the 2017 Tax Cuts and Jobs Act TCJA.

Paid a flat rate. Learn how to calculate and adjust your tax withholding with the Form W-4 so that you can get more money per paycheck instead of a large tax refund every year. Figure out your filing status.

Unlike your 1099 income be sure to input your gross wages. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Multiply 188 by a stated wage of 20 and you get 3760.

You can determine the value of your adjusted gross income from different lines on various forms. On long road trips knowing how many miles you are averaging per hour can give you an idea of how long it will take to get to your destinationIt is also a good indicator if you are taking too many breaks or if traffic has caused delays in your journey. Register to save paychecks and manage payroll the.

California Paycheck Calculator Smartasset

How To Calculate Federal Income Tax

Paycheck Calculator Take Home Pay Calculator

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Pay And Net Pay What S The Difference Paycheckcity

Salary Paycheck Calculator How Do You Calculate Your Take Home Pay Marca

Gross Pay And Net Pay What S The Difference Paycheckcity

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How To Calculate Federal Withholding Tax Youtube

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

How To Calculate Net Pay Step By Step Example

Paycheck Calculator Online For Per Pay Period Create W 4

Understanding Your Paycheck